how to check tfsa contribution room

Or you can get your balance by phoning CRAs Tax Information Phone Service. The TFSA program began in 2009.

Tfsas And Rrsps Deborah Bongard Bmo Nesbitt Burns

Press 1 for english 5 for registered accounts Then 3 for TFSAs Lastly 1 for room Double check.

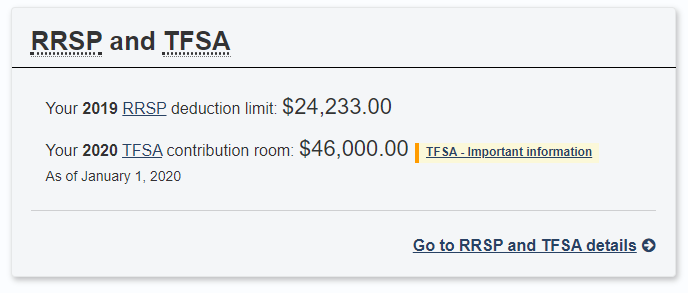

. The Canada Revenue Agency CRA tracks your contribution room. And well add another 6000 the 2021 contribution room to 10725 which equals 16725. So if you open a new TFSA in 2021 and do not have a TFSA elsewhere. You can see your TFSA balance as of January 1 of the current year by logging in to your CRA My Account.

How to check your TFSA contribution room. How to check your TFSA contribution room. If you are a Canadian resident your contribution room begins accumulating from 2009 or from the year in which you turned 18. For example lets say youve just contributed your first 10000 in your TFSA but your contribution limit for the current year is 15000 this leaves you with 5000 in contribution room.

Your contribution room consists of the current years contribution limit any unused contribution room that you have accumulated from previous years and the total value of TFSA withdrawals made in the previous year. Based on what happened to some Questrade customers it might be worth checking your TFSA contribution room once in a while in case any mistakes have been made. You can see your TFSA balance as of January 1 of the current year by logging in to your online My Account on the CRA website. You can see your TFSA balance as of January 1 of the current year by logging in to your online My Account on the CRA website.

Or you can get your balance by phoning CRAs Tax Information Phone Service. As a reminder a TFSA allows any Canadian over the age of 18 to save or invest money in a tax-free account. You can check the details of what they are using by phoning the CRA at 1 800 959 8281 or by going online using the My Account service. You will accumulate TFSA contribution room for each year even if you do not file an Income Tax and Benefit Return or open a TFSA.

Check after mid-February to allow time for your. For that reason it is better to add up your own contribution room. Only contributions made under a valid SIN are accepted as TFSA contributions. If you only invested 10000 into your TFSA and you earned an additional 10000 in capital gains your TFSA balance would be.

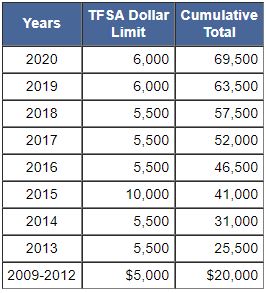

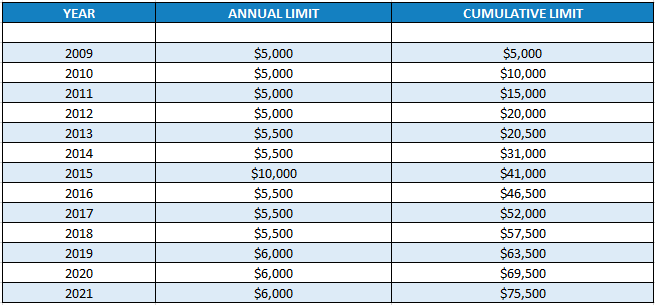

Contributions to a TFSA are not deductible for income tax purposes. Call 1-800-267-6999 it is an automated system. The annual TFSA dollar limit for the year 2015 was 10000. However its a good idea to track your contributions and withdrawals because transactions from the.

Basically Im wondering how much contribution room I will have come January 1st for my TFSA which is a TD Direct Investing TFSA that I manage using WebBroker. The annual TFSA dollar limit for the years 2013 and 2014 was 5500. You can also check the CRA website or use the MyCRA app to find out how much room you have. That means Alex can contribute 16725 to her TFSA this year.

Banks credit unions etc are required to electronically submit. Today I show you step by step how to check your TFSA Contribution Limit on the CRA Website. I have different kinds of investments in the account I make irregular contributions to the account and I have withdrawn from the account this year as well as in previous years. It is a way for individuals who are 18 years of age or older and who have a valid social insurance number SIN to set money aside tax free throughout their lifetime.

The TFSA contribution limits on the CRA account are not always accurate and sometimes newer residents will find that the amount listed seem to assume that they gained room as soon as they turned 18. Your TFSA contribution room is the maximum amount that you can contribute to your TFSA. TFSA contribution room accumulates every year even if you havent opened a TFSA. As we mentioned above any gains or losses made in your TFSA can have an impact on your cumulative contribution room.

The TFSA account is relatively new and often referred to as a younger sibling to the RRSP. Canada Revenue Agency tracks your contribution room. Look for the 2021 TFSA contribution room on January 1 2021. While TFSAs are amazing and almost too good to be true for that matter there is a limit to how much you can invest in it each year.

How to check TFSA contribution room. The annual TFSA dollar limit for the years 2009 to 2012 was 5000. By the last day of February of the following year all institutions ie. I commonly hear or read online people wondering how they can check their TFSA limit Contribution Limit as they want to ensure they dont over-contribute.

Your can find that number on your Notice of Assessment. This value is your most accurate contribution room since the date. Your contribution room accumulates each year in which you are 18 years of age or older and a resident of Canada even if you dont file an income tax return or open a TFSA. Keep in mind that while theres no limit to the number of TFSAs an individual can open your contribution limit will remain the same.

If you were 18 or older in 2009 your TFSA contribution room grows each year even if you. Canada Revenue Agency tracks your contribution room. How to check your TFSA contribution room. Find out your TFSA Contribution Room Using the CRA Telephone Information Phone System TIPS Posted on 2013 04 01 by BetCrooks You can not double-check when you contributed to your TFSA using the Canada Revenue Agencys Telephone Information System TIPS.

Any contributions or withdrawals this year will not be included in this number. TFSA contribution room calculator. How to Check TFSA Contribution Room. Here are the annual amounts.

Your TFSA contribution room will not decrease as your dividend income increases your account value. Or you can get your balance by phoning CRAs Tax Information Phone Service. The TFSA contribution limits starts accumulating once you turn 18 unlike RRSP where you need to have income. The choice of investing in your TFSA or RRSP first is still a debated question but what isnt up for debate is your contribution amount per year and how much you accumulate in contribution room.

The simplest way to check your contribution room is to log into My Account on the Canada Revenue Agency website. Tax free means that you dont pay taxes on. The secret to maximizing your TFSA contribution room is actually quite simple.

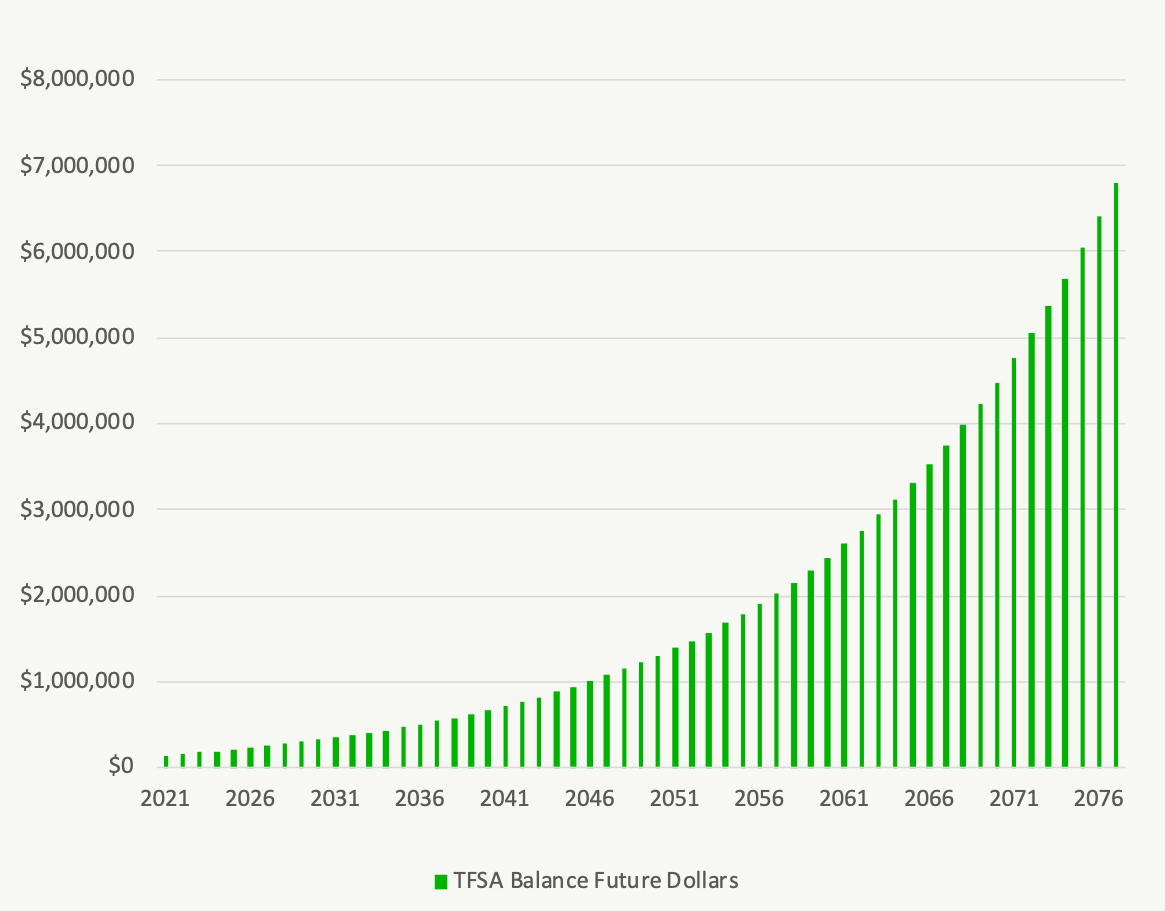

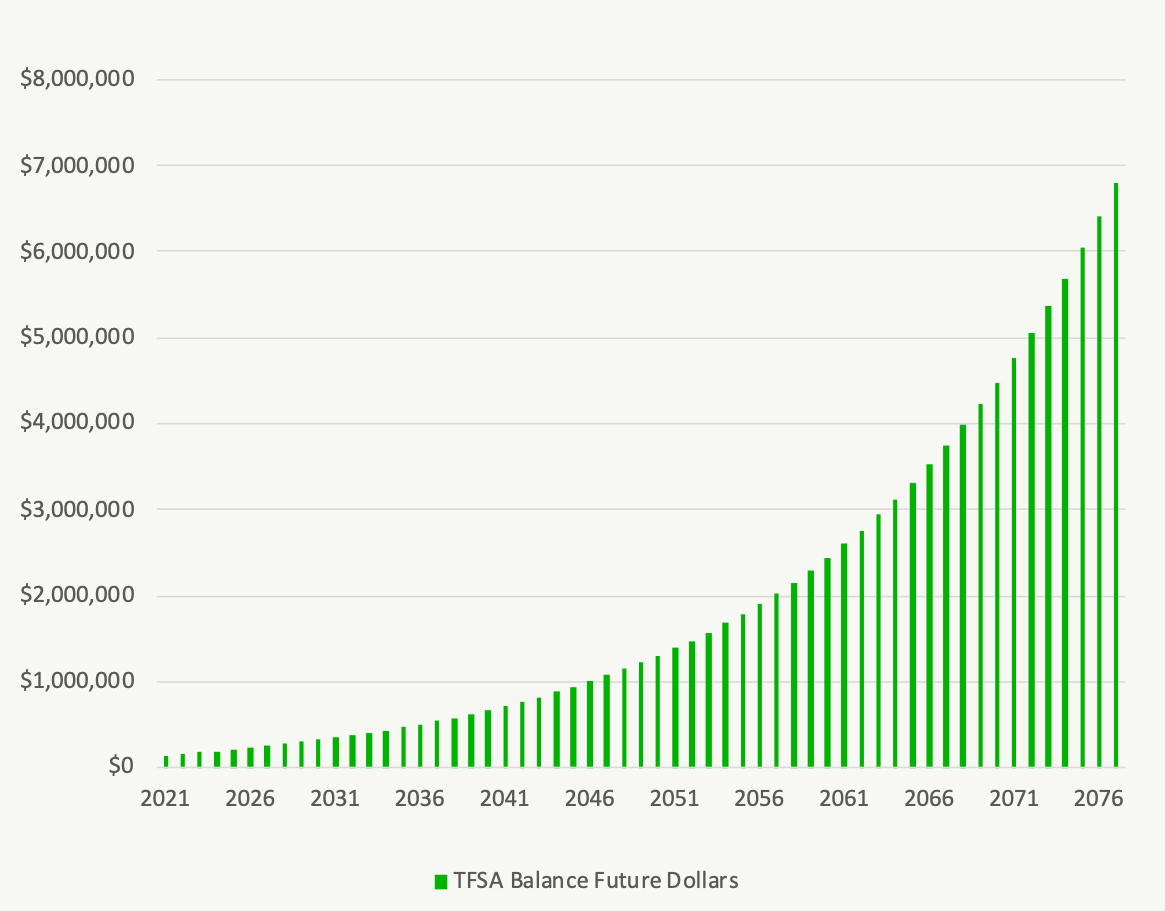

The New Tfsa Contribution Limit How Big Could Your Tfsa Get If You Contribute The Max Each Year Planeasy

How Do You Find Out Your Tfsa Contribution Room

Lighthouse Financial Planner S Corner Tfsa Limit Increase

4 Reasons To Max Out Your Tfsa Forbes Wealth Blog

Tfsa Contribution Room How To Really Maximize Your Tfsa

You Should Be Maxing Out Your Tfsa Forbes Wealth Blog

Tfsa Limit For 2021 Announced Fbc

How To Calculate Your Tfsa Contribution Limit Money After Graduation

Posting Komentar untuk "how to check tfsa contribution room"